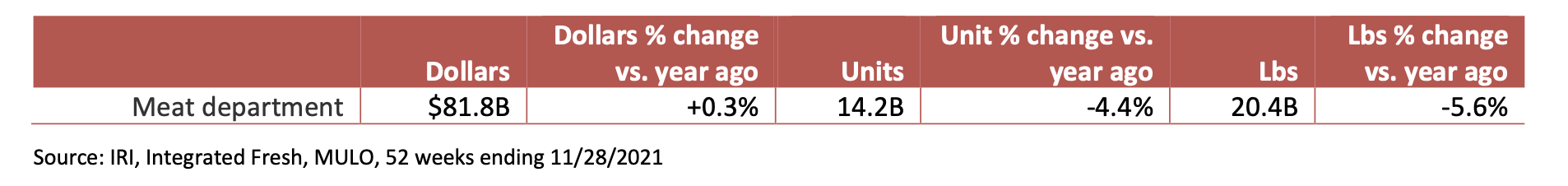

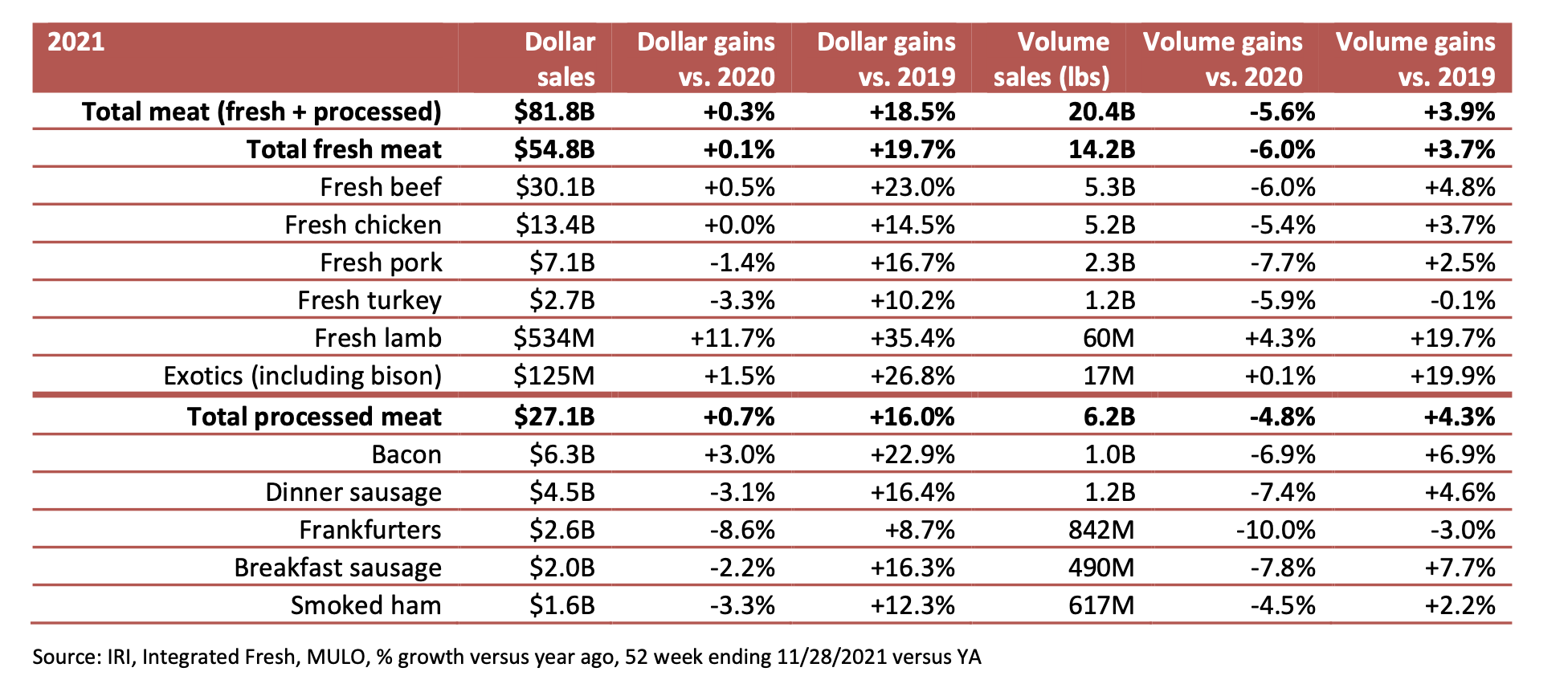

Following the record-breaking gross sales of meat as a result of influence of the pandemic in 2020, greenback gross sales continued to rise in 2021, with an 0.3% enhance for a complete of $81.8 billion in gross sales — although these numbers had been pushed by important inflation, in accordance with the 2022 Energy of Meat report launched Tuesday. Tellingly, quantity and unit gross sales fell in need of the prior-year report ranges, at -5.6% and -4.4%, respectively.

“In 2020, shoppers bought totally different quantities, manufacturers, sorts and cuts of meat and poultry. Above all, they purchased extra meat and poultry than they ever had, creating a really troublesome path for progress in 2021,” famous the annual examine, which was carried out by 210 Analytics on behalf of FMI—The Meals Business Affiliation and the Meat Institute’s Basis for Meat and Poultry Analysis and Training.

Nonetheless, taking 2020’s report gross sales as an outlier, quantity gross sales in 2021 had been up 3.9% when in comparison with pre-pandemic ranges. This enhance is due, partly, to a number of grocery shopper developments ensuing from the COVID-19 pandemic, together with elevated dwelling cooking, record-high on-line buying and a shift to digital sources for recipe inspiration, in accordance with the report.

“The Energy of Meat reveals Individuals proceed to rely on meat’s style, high quality, comfort and worth all through one other uncommon and difficult 12 months,” stated Julie Anna Potts, president and CEO of the Meat Institute.

Whereas beef and hen have dominated meat division gross sales for a very long time, because the onset of the pandemic, beef’s share has elevated in each {dollars} and quantity on very robust floor beef and premium reduce gross sales. Beef greenback gross sales had been greater than all the opposite recent meat classes mixed in 2021.

In processed meat, bacon and dinner sausage had been the large sellers. Bacon {dollars} gained each year-on-year and versus 2019, however was the one processed meat class to take action. Except scorching canine, processed meat did transfer extra kilos in 2021 than in 2019.

In accordance with the Energy of Meat, 74% of Individuals describe themselves as meat eaters. Meat division visits declined barely much less this 12 months (50.4 visits per shopper per 12 months), however consumers spent a little bit extra throughout every journey. In response to increased costs and inflation pressures, consumers are consuming out and ordering in from foodservice much less typically, whereas making an attempt to recreate restaurant experiences at dwelling as an alternative, and have adjusted retail meat buy habits. Quantity stays considerably above pre-pandemic ranges for recent (up 3.7% since 2019) and ready meats (up 4.3% since 2019). Contemporary beef quantity elevated almost 5% since 2019, bacon 7%, and recent lamb gross sales elevated almost 20%. Extra meat shoppers shopped on-line than ever (61%, up from simply 39% in 2019), and almost half of meat consumers (46%) at this time store on-line recurrently.

In different findings, Individuals are consuming 80% of meals at dwelling (down from 88% on the pandemic peak in April 2020), and 57% put together 4 to seven dinners per week with meat. Greater than half of meat consumers (51%) say web sites, apps and social media are their prime sources for meat preparation recommendation. Of those that search on-line for meat cooking suggestions and concepts, 72% use Google or one other search engine and 57% use YouTube. Pinterest, Instagram and TikTok are notably well-liked with Era Z and Millennials — utilized by round half of consumers in these generations for locating meat preparation inspiration. For instance, 53% of Gen Z discover meat inspiration on TikTok, in comparison with simply 4% of Boomers. The highest three searches for all generations are by kind of meat, particular cuts and particular preparation strategies (like air fryers).

“Consumers’ meat IQ is increased than ever, and the Energy of Meat reveals they’re searching for much more methods to buy meat and get inspiration for getting ready meals,” stated Rick Stein, vp of recent meals for FMI. “Retailers are continuously working to provide consumers extra decisions within the meat division and additional improve in-store and on-line buying choices.”

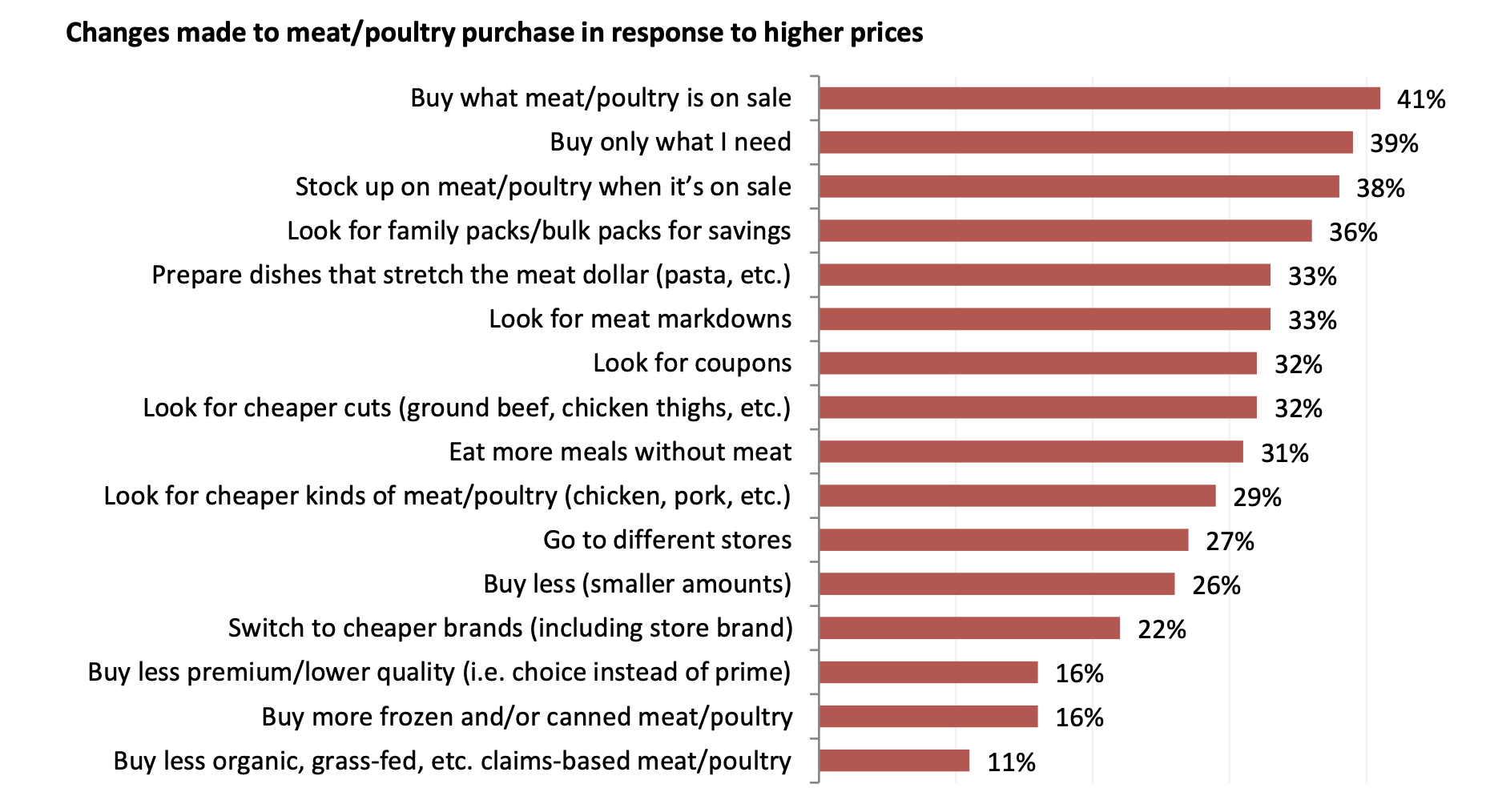

The widespread provide chain disruption throughout classes mixed with in depth client media protection has shoppers very conscious this time. For example, three-quarters of shoppers famous that the price of groceries and the price of meat/poultry is up over the previous few months, with the survey fielding mid-December. On the identical time, 43% are seeing fewer meat and poultry promotions.

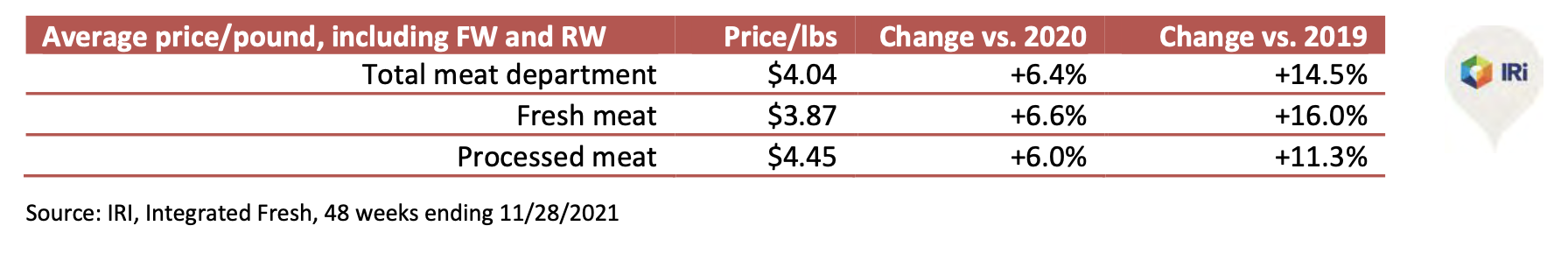

In December 2021, the U.S. Bureau of Labor Statistics reported the most important year-on-year enhance in inflation in 40 years. The buyer worth index elevated 7.0%. IRI information reveals worth will increase throughout protein commodities. In January by means of November 2021, meat costs throughout all species, mounted and random weight, averaged $4.04, which was up 6.4% versus 2020 and +14.5% versus 2019.

Each retailers and the remainder of the meat provide chain have struggled with labor shortages all through 2021. In a survey with retailers by 210 Analytics, 91% of grocery retailers cited having bother filling meat division openings or having sufficient labor to cowl all accessible labor hours. Whereas all have made time beyond regulation accessible, 39% have resorted to shortening service counter hours and a few retailers have shortened retailer opening hours altogether, although typically on a store-by-store foundation.

Shoppers, by and enormous, haven’t observed a marked distinction in accessible help within the meat division, with the majority of purchases coming from the self-service case. About one-quarter (23%) famous much less accessible help.

In all, 89% of shoppers have famous some modifications to their meat division, whether or not extra out-of-stocks, fewer accessible cuts, and so forth. In flip, the modified market situations resulted in modified meat purchases for 58% of consumers, with above common shares for city and rural consumers.

Consumers who made a change chosen a mean of three explanation why they purchased otherwise. Out-of-stocks of sure protein sorts, adopted by non- availability of particular cuts, had been prime causes for making modifications to the standard meat buy. Lack of desired package deal sizes and searching for one thing a little bit cheaper had been often cited causes as properly. Experimentation, which was prevalent in 2020, was a minor motive, at 10%.