Interested by opening an H&R Block franchise and questioning how a lot it may cost? I break down all the prices on this evaluation, however there are some main modifications you want to perceive you want to perceive in regards to the private tax preparation trade.

One factor you want to perceive is H&R Block is shifting into the DIY tax trade, which is able to presumably influence franchise shops. Why? The variety of new clients in search of the options of H&R Block franchise shops will decline as individuals submitting easy tax returns with assist of DIY software program. Because the Child Boomer era continues to retire and youthful employees earn the workforce, anticipate this to pattern to proceed over the following 5 – 10 years.

Are loads of H&R Block franchises closing down? Why?

Throughout its yearly analysis in 2018, H&R Block made the choice to close down over 400 smaller operations throughout the nation. Low-profit margins and declining gross sales have been the explanations given for this, the corporate mentioned. Prospects not must have the prolonged, complete tax preparation companies provided by the corporate on account of workplaces being too shut to one another.

Even if H&R Block has a historical past of closing websites after tax season, the current lack of 400 shops and important inventory losses have some monetary specialists on edge. Learn on to be taught extra about franchising with H&R Block or take our 7-minute franchise quiz to be matched with a chance primarily based in your distinctive pursuits.

Monetary Necessities and Charges

To open a brand new tax workplace, franchisees should pay for the required lease, furnishings, and gear (variable bills). It’s projected the full value to open an H&R Block franchise is between $31,505 and $149,200.

Apart from a refundable $2,500 safety deposit, H&R Block doesn’t cost an preliminary franchise charge. Right here’s a have a look at the charges related to beginning this enterprise.

| Sort of Price | Low | Excessive |

| Safety Deposit | $2,500 | $2,500 |

| Begin-up Provides | $500 | $500 |

| Leasehold Enhancements; Building Bills | $0 | $50,000 |

| Gear | $8,000 | $12,000 |

| Actual Property (Projected whole value is for 3 months) | $1,400 | $30,000 |

| Opening | $500 | $1,000 |

| Signage | $1,200 | $6,500 |

| Pre-opening Salaries, Journey and Preliminary Coaching | $1,500 | $3,000 |

| Furnishings and Decor Gadgets | $15,000 | $30,000 |

| Utility Deposits | $50 | $300 |

| Insurance coverage | $477 | $798 |

| Architect Design | $0 | $4,500 |

| Zoning Prices | $0 | $500 |

| Relevant Enterprise Licenses, if crucial | $0 | $1,800 |

| Skilled Charges | $0 | $2,500 |

| Further Capital | $430 | $12,000 |

| Projected Complete Charges | $31,557 | $157,898 |

Monetary Necessities

There are territories obtainable for brand new H&R Block franchises. There are additionally alternatives to accumulate already-established franchises from current operators. H&R Block does present monetary assist within the type of a franchise fairness line of credit score for potential franchisees who require such help. Listed below are a few of the monetary necessities required to function this tax preparation enterprise.

|

Requirement |

Price |

| Liquid Capital | $2,500 |

| Web Value | N/A |

| Complete Funding | $31,557 to $157,898 |

| Franchise charge (safety deposit) | $2,500 |

Except in any other case acknowledged, the preliminary franchise interval final for a interval of ten years, terminating on June 1 of the tenth full tax season. There isn’t any computerized extension, though the franchisor is allowed to supply its franchisees to different entrepreneurs sooner or later.

Franchise Companion, Inc. (FPI), a subsidiary of the franchisor, gives H&R Block franchisees with business finance, topic to credit score approval. The Time period Mortgage Credit score and Safety Settlement and yearly Brief-Time period Mortgage Credit score and Safety Settlement comprise a whole checklist of the provisions for FPI’s customary mortgage product.

Solely the acquisition of an H&R Block franchise, one other tax preparation firm, the buyout of a accomplice, and the refinancing of a U.S. mortgage are permitted makes use of for FPI’s time period mortgage. You might additionally apply for a mortgage by the Small Enterprise Administration. Previous to the beginning of every tax season, FPI’s short-term mortgage could also be used to pay a few of the working bills. Franchisees are allowed to take out loans from different lenders and should not obligated to safe financing from FPI.

Assist enterprise house owners put together their taxes.

How A lot Revenue Does An H&R Block Franchisees Make Per Yr?

Firm income / gross sales per 12 months: H&R Block’s annual income for the 12 months 2022 reached $3.463B, which is a 1.44% enhance from 2021. Within the 12 months ending June 30, 2022, H&R Block posted a ten.71% development year-over-year.

Variety of items: As of 2021, H&R Block has a complete of 9,361 whole items in the US. This quantity accounts for each franchised and company-owned items.

Common Gross Income Per Retailer: $3,463,000,000 (System-wide gross sales) ÷ 9,361 items = $369,939.11. This can be a again of the serviette estimate primarily based on publicly obtainable information.

Business Common Revenue Margin: Understanding and being conscious of your revenue margins is crucial for sound monetary administration. To ensure that accounting organizations to calculate revenue margins, it’s crucial to think about the unnoticed variables, that are ceaselessly qualitative and intangible. Calculating your organization’s ROI is the thought—you wish to know if it’s really good or not.

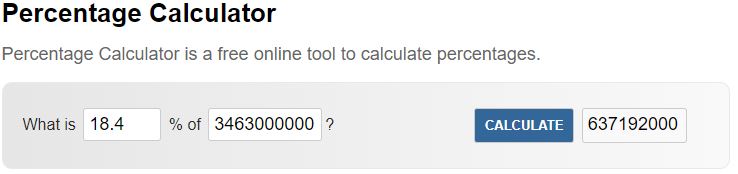

In accordance with evaluation, the small enterprise sector the place accounting, tax preparation, bookkeeping, and payroll companies with a pre-tax web revenue margin of 18.4% in 2017. Based mostly on this estimate, it’s best to anticipate to make $63,719 after bills yearly. Remember you would enhance profitability by working contained in the enterprise your self.

Projected Annual Revenue Per Retailer:

H&R Block SWOT Evaluation

By fastidiously analyzing and revising a SWOT evaluation, you may achieve insights into the trajectory of H&R Block as a enterprise.

Strengths

1. Robust Model Picture – Within the private companies sector, H&R Block’s merchandise get pleasure from nice model recognition. Compared to its rivals within the private companies sector, this has allowed the company to earn extra. Their clients are conscious of the long-standing, well-known model H&R Block. Consequently, it has a powerful status amongst its clientele.

2. Distinctive Buyer Satisfaction – The enterprise has been profitable in reaching a excessive stage of service high quality amongst present clients and robust model worth amongst potential customers due to its specialised shopper relationship administration division.

3. Gifted And Skilled Workforce – The employees at H&R Block is made up of competent and licensed people. H&R Block has made important investments within the improvement of its employees, which has enabled it to rent a substantial variety of motivated and expert employees. Because of this, the employees is not only extremely certified but additionally pushed to perform extra.

You Would possibly Like: Ought to You Work with a Franchise Dealer? (The Good and Unhealthy)

4. Excellent Ends in Untapped Markets – H&R Block has developed proficiency in breaking into and succeeding in new markets. The corporate’s enlargement has enabled it to develop new income streams and unfold the danger of the financial cycle within the markets it serves. The event of recent items and enlargement into new markets have been made potential by H&R Block’s artistic groups. Prior to now, it has had success with the vast majority of its initiatives in new markets.

5. Commendable Capital Expenditure Returns – Prior to now, H&R Block has been in a position to efficiently present constructive outcomes on the capital expenditures it has invested in a wide range of initiatives. H&R Block has a strong monitor report of finishing new initiatives, and thru creating new income sources, it has produced good returns on capital investments.

6. Efficient Distribution Community – In an effort to cowl the vast majority of its potential market, H&R Block has developed a strong distribution community all through time. With a number of areas in virtually each state and a sturdy distribution community behind them, H&R Block ensures that its companies are shortly and simply accessible to a large variety of purchasers.

7. Robust Social Media Presence – On the three hottest social media platforms—Fb, Twitter, and Instagram—H&R Block has greater than hundreds of thousands of followers, demonstrating its important on-line presence. On these platforms, there’s loads of buyer interplay and a fast response fee.

8. Intensive Product Portfolio – H&R Block presents objects throughout a variety of sectors in its expansive product line. It gives a wide range of distinctive merchandise that its rivals don’t. H&R Block has dabbled in plenty of industries apart from companies through the years. Because of this, the enterprise has been in a position to diversify its income sources past the companies trade and the private companies sector.

9. Partnerships and Integration – Profitable mergers and acquisitions by H&R Block have allowed it to mix complementary companies. It has successfully merged plenty of expertise companies lately to streamline operations and create a reliable provide chain. H&R Block varieties strategic alliances with its distributors, companions, retailers, and different events. Sooner or later, if crucial, it might probably use this to its benefit.

10. Main Place within the Market – Within the private companies sector, H&R Block holds a commanding market share. It has aided the enterprise in shortly scaling up the successes of recent companies. Prospects nonetheless benefit from the options they supply as a result of they’ve remained of top of the range all through time they usually imagine they get good worth for his or her cash.

Weaknesses

1. Elevated Day Gross sales Stock – Because it takes longer than typical for companies to purchase and promote issues, H&R Block accumulates stock, which provides useless bills to the corporate’s operations. H&R Block’s long-term development is impacted on account of the corporate having to boost extra money to spend money on the channel.

2. Analysis and Improvement – H&R Block has to take a position further funds in expertise to unify the operations throughout the board given the scope of the enlargement and the assorted areas the enterprise plans to broaden into. The corporate’s imaginative and prescient at present doesn’t match the extent of expertise funding. H&R Block spends extra on analysis and improvement than the trade common, however far lower than a couple of opponents who’ve benefited drastically from their cutting-edge improvements.

The old-school means of getting ready taxes.

3. Excessive Charge Of Employees Attrition – H&R Block has a better turnover fee than different companies within the sector, and due to this fact should spend far extra money on worker improvement and coaching than its rivals. On condition that there are fewer staff than the quantity of labor that must be performed, the burden is excessive per worker. Workers are prone to be much less environment friendly on account of the psychological stress this causes.

4. Outdated Organizational Construction – The one enterprise mannequin that’s in keeping with H&R Block’s organizational construction is the present one, which prevents the corporate from increasing into associated product sectors. Since decision-making is closely centralized, groups should get approval from sure officers for his or her choices. Because of the elevated time required, this lowers operational effectivity. Restricted improvement is one other results of this weak point.

5. Lowered Present Ratio – Monetary planning is just not carried out successfully or appropriately. The company can spend the money extra successfully than it’s at present doing, in accordance with the present asset ratio and liquid asset ratios. The corporate has a decrease present ratio than the trade common, which signifies its capability to fulfill short-term monetary obligations. This might suggest that the enterprise might expertise future liquidity points.

Alternatives

1. Elevated Shopper Spending – Within the wake of the recession, each shopper expenditure and the typical family earnings have elevated. Because of this, H&R Block’s goal market will broaden as extra potential clients are drawn to the corporate. H&R Block might discover new markets on account of rising tendencies in shopper habits. The corporate has a implausible alternative to develop new income sources and diversify into different product classes because of this.

2. Emergence of E-Commerce – The e-commerce sector’s gross sales have elevated and a brand new pattern has emerged. This means that many shoppers are actually doing on-line purchases. By establishing on-line storefronts and producing gross sales by them, H R Block can herald income. The enterprise has put a large quantity of capital into the digital platform over the previous couple of years. With this funding, H&R Block now has entry to new gross sales channels. By attending to know its clients higher and assembly their calls for with large information analytics, the group can benefit from this potential within the coming years.

3. Decrease Inflation Charge – Over the following two years, it’s anticipated that the low inflation fee will persist. On condition that its enter prices would keep low for the next two years, H&R Block has a chance. The market is extra secure because of low inflation, which additionally permits H&R Block customers to acquire loans at cheaper rates of interest. Elevated consumption of H&R Block objects may end result from decrease inflation charges.

4. Relaxed Commerce Settlement – H&R Block now has the chance to entry a brand-new, rising market due to the adoption of recent technological requirements and authorities free commerce agreements. Commerce restrictions on the import of commodities have been lowered. The worth of manufacturing inputs will go down because of this.

You Would possibly Like: Is Nice Clips a Good Franchise to Personal? (+ Complete Value to Open)

5. Developments In Expertise – There are numerous benefits to expertise throughout many departments. Automation of processes can decrease working bills. Improved buyer information assortment and advertising operations are made potential by expertise. The event of expertise may current H&R Block with an opportunity to implement a differentiated pricing strategy within the rising market. It should make it potential for the enterprise to draw new purchasers with further value-focused presents whereas retaining its current clientele with wonderful service.

6. Decrease Tax Charge – The brand new tax legal guidelines might have a big impact on how companies are carried out and will current new alternatives for established companies like H&R Block to enhance their profitability. H&R Block will profit from the federal government’s decrease tax fee since there will probably be a smaller tax expense.

Threats

1. American Isolationism – The rising pattern of financial isolationism in the US might trigger different governments to reply equally, which might damage worldwide commerce. Plans for H&R Block’s enlargement could possibly be hampered by the strained commerce relations between the US and China. A full-scale commerce struggle might hamper the likelihood for H&R Block to develop operations in China on account of this.

2. Expert Workforce Scarcity – The dearth of skilled employees in some worldwide markets threatens H&R Block’s means to keep up sustainable earnings development in such markets. As well as, H&R Block might quickly encounter points with its human sources because of the excessive employees turnover and rising reliance on artistic options.

3. Excessive Gasoline Costs – Sourcing bills for H&R Block have gone up because of the enhance in gasoline costs. These bills have grown on account of rising gasoline costs which have additionally affected different industries that this enterprise depends on for sources, which has led to increased costs.

4. Stiff Competitors – Costs are being pushed down on account of elevated trade rivalry. If H&R Block doesn’t reply to the pricing will increase, it might lose market share. If it does, it might lead to much less earnings. Since there are actually extra opponents out there because of secure profitability, each profitability and total gross sales have been beneath strain.

5. Demographic Shifts – In mild of the newborn boomers’ impending retirement, the youthful era is struggling to match their buying energy. Because of the youthful generations’ decrease model loyalty and better openness to attempting new issues, H&R Block might expertise a rise in short-term earnings on the expense of a longer-term margin discount. As a consequence of shifting shopper preferences, companies are beneath strain to adapt their choices regularly to fulfill these customers.

Is the H&R Block Definitely worth the Value to Make investments?

Get monetary savings with skilled tax preparation.

Is it worthwhile to spend money on an H&R Block franchise? The reply will decide in your pursuits, expertise, and private funds. Listed below are some probing inquiries to ask your self and uncover if it’s the suitable path for you.

- Do you’ve gotten related work or enterprise expertise operating a tax and accounting agency?

- Do you get pleasure from doing taxes for small companies and people?

- Do you’ve gotten connections or different in-roads with small companies that you would contact to be purchasers?

- Do you’ve gotten expertise with native advertising?

The tax trade is in transition due largely to automation by software program. With that being mentioned there’s nonetheless loads of alternative to work with small, medium and enormous companies. The larger the enterprise and extra staff provides complexity and makes it tougher to automate the tax submitting course of by software program.

A Transient Historical past of H&R Block

H&R Block, Inc., also called H&R Block, is an American tax preparation enterprise that has operations in Canada, Australia, and the US, and. Henry W. Bloch and his brother Richard launched the enterprise means again in 1955.

Henry W. Bloch sought to launch a household enterprise in Kansas Metropolis throughout World Battle II alongside his brothers. Henry was impressed by a brochure he noticed in 1946 that predicted a greater future for companies that help small companies. In that very same 12 months, Henry and his elder brother Leon took out a $5,000 mortgage to start out a modest bookkeeping agency on Fundamental Avenue within the coronary heart of Kansas Metropolis. 4 months later, although, they struggled to search out purchasers, and Leon made the choice to enroll in regulation college.

You Would possibly Like: Is Westin Inns & Resorts Franchise Definitely worth the Value to Make investments?

Henry revealed an extra help advert within the native paper as a way to proceed his unsuccessful enterprise. His mother, who had unexpectedly responded, prompt that Henry make use of his youthful brother, Richard, for the place. Collectively, Henry and Richard Bloch managed their accounting, bookkeeping, and payroll-focused firm. In 1955, the brothers positioned an commercial in The Kansas Metropolis Star promoting their $5 tax companies, the remaining was historical past.

Who Owns H&R Block?

By controlling 92.16% of the excellent shares of HRB, institutional traders personal a majority stake within the firm. Moreover, this curiosity is increased than it’s at virtually another enterprise within the Different Shopper Companies sector. In the course of the quarter that led to April 2019, these large traders purchased shares for a web $2.3 million.

Main these institutional traders is The Vanguard Group, Inc. with 19,375,174 shares owned, or a 12.11% stake within the firm. They’re adopted by BlackRock Fund Advisors with 10.66%, Jupiter Asset Administration Ltd. with 5.75%, SSgA Funds Administration, Inc. with 4.79%, and Constancy Administration & Analysis Co. with 4.71% amongst a broad checklist of traders.

Is H&R Block affiliated with the IRS?

The best reply to this query is a no. At the start, the IRS is the federal government’s federal company tasked to oversee tax assortment in addition to the implementation of tax legal guidelines. H&R Block in the meantime is a privately-owned listed auditing agency providing tax preparation companies to taxable people and companies.

Nonetheless, H&R Block processes tax preparation for his or her purchasers to ensure that them to have a seamless transaction with the IRS as an alternative of them immediately doing it themselves. In a way, they work hand in hand, H&R Block facilitating tax returns to the IRS.