A lot to the dismay of U.S. buyers, client costs jumped greater than 6% in October, boosted primarily by surging gasoline costs but additionally continued excessive inflation for meals.

The Client Worth Index (all city shoppers) rose 6.2% year-over-year (unadjusted) for October, the U.S. Bureau of Labor Statistics (BLS) reported yesterday. What’s extra, the 0.9% month-to-month improve (seasonally adjusted) greater than doubled the 0.4% uptick from August to September.

Meals pricing was up 5.3% 12 months over 12 months in October, with the month-to-month acquire of 0.9% the identical as in September. Meals-at-home costs climbed 5.3% throughout October versus a 12 months earlier, however the month noticed the second straight sequential improve of 1% or extra. Month-to-month food-at-home pricing escalated 1% for October and 1.2% for September, the very best for the 12 months thus far.

As compared, food-away-from-home index in October superior 5.3% from a 12 months in the past, with a month-to-month improve of 0.8%, up from 0.5% for September.

Elevated power prices had been the principle perpetrator for October’s CPI surge, up 30% 12 months over 12 months and 4.8% month to month. Gasoline and gasoline oil costs jumped 49.6% and 59.1%, respectively, versus a 12 months in the past. The month-to-month upticks had been 6.1% for fuel and 12.3% for gasoline oil.

Excluding meals and power, October’s CPI rose 4.6% from a 12 months in the past and 0.6% from a month in the past, in line with BLS.

Within the food-at-home phase, the entire six main grocery-store meals group indexes had been up for October versus a 12 months earlier. The index for meat, poultry, fish and eggs climbed 11.9%, together with will increase of 20.1% for beef and 14.1% for pork, its largest 12-month uptick since December 1990, BLS famous. During the last 12 months, will increase within the different main grocery meals indices ranged from 1.8% in dairy and associated merchandise to 4.5% in non-alcoholic drinks.

Month-to-month good points in grocery meals indices for October included 1.7% for meat, poultry, fish and eggs (following a 2.2% uptick in September); 3.1% for beef; 1.1% for cereal and bakery merchandise (following a 1.1% improve in September); 0.8% for non-alcoholic drinks; 0.2% for dairy and associated merchandise; and 0.1% for fruit and greens. BLS stated the index for “different meals at residence” rose 1.2% from the earlier month, the phase’s largest month-to-month improve since April 2020, simply after the onset of the COVID-19 pandemic.

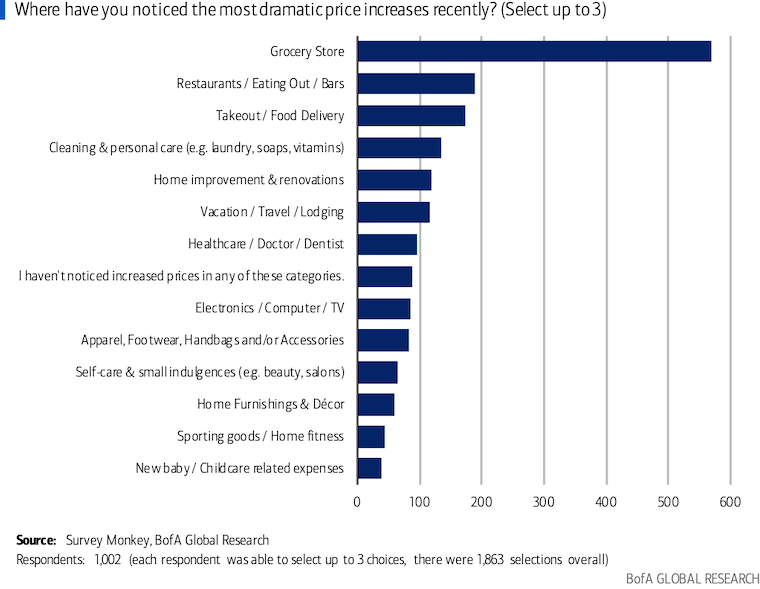

Client notion of latest value will increase throughout classes

The continuing value hikes aren’t being neglected by meals buyers.

When respondents in BofA World Analysis’s October Client Spending Survey, launched this week, had been requested the place they’ve seen probably the most dramatic value will increase not too long ago, practically 60% of the 1,000 buyers polled cited the grocery retailer. Over the following three months, 30% of shoppers stated they anticipate to spend extra in grocery, the next proportion than in another product/service class.

Almost 30% of shoppers within the BofA ballot named the grocery retailer because the class/venue the place they anticipate probably the most dramatic improve of their spending over the following 12 months. On the flip aspect, roughly 15% additionally cited grocery shops because the place the place they’ve not too long ago seen probably the most dramatic uptick in reductions, promotions and value reductions. Additionally, 20% of respondents reported that, over the previous few months, they selected to not purchase a grocery merchandise (meals and/or drinks) as a result of they couldn’t discover a good value or the choice was poor.

“Forward of two of probably the most food-centric U.S. holidays, provide chain disruptions are elevating grocery payments — and shoppers are noticing. Amid media reviews about surging grocery prices, practically seven in 10 U.S. shoppers anticipate costs for meals and non-alcoholic drinks to extend this vacation season in contrast with earlier years,” in line with Emily Moquin, meals and beverage analyst at knowledge intelligence agency Morning Seek the advice of.

“Elevated consciousness of provide chain points is driving shoppers’ expectations of upper grocery costs,” she famous in a report this week on vacation meals spending. “Amongst those that say they’ve heard ‘so much’ concerning the provide chain disaster, the proportion who anticipate grocery costs to extend this 12 months climbs 16 proportion factors to 85%.”

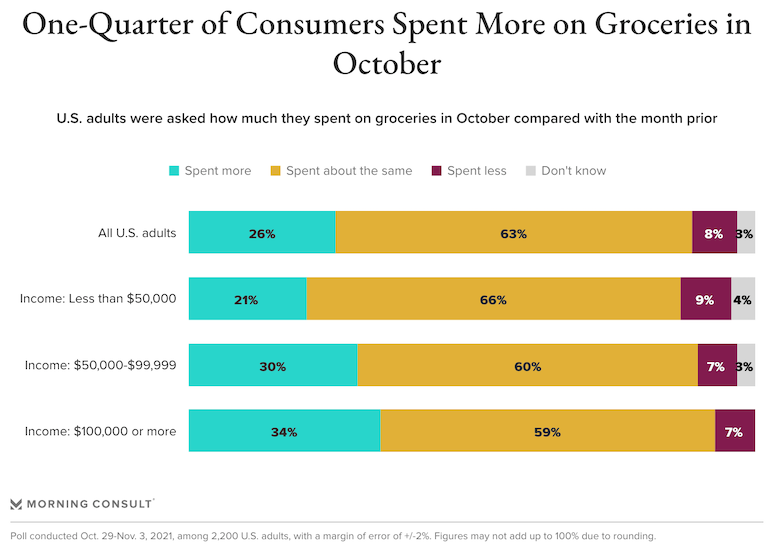

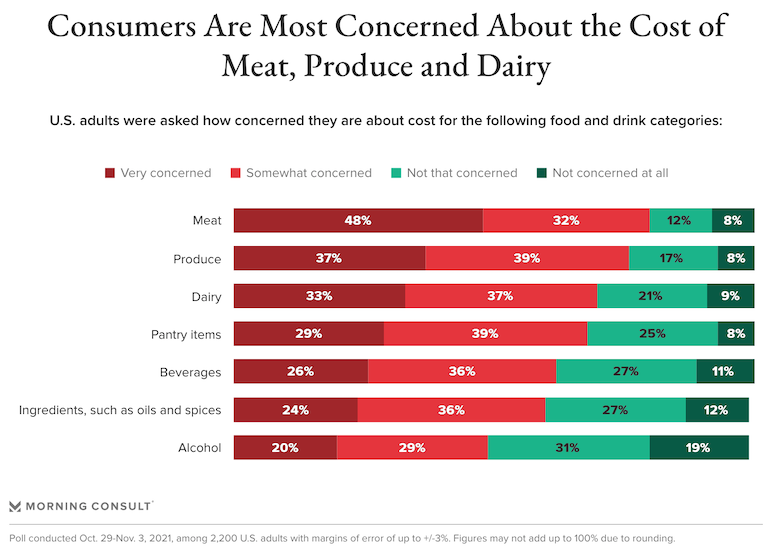

Of two,200 U.S. adults polled Oct. 29 to Nov. 3 by Morning Seek the advice of, 26% stated they spent extra on groceries in October versus the earlier month, whereas 63% reported they spend about the identical. Greater than half of respondents had been “very or considerably involved” about the price of meat (80%), produce (76%), dairy (70%), pantry objects (68%), drinks (62%) and substances like oils and spices (60%). Forty-nine % had been “very or considerably involved” about alcoholic beverage pricing.

“To save cash on grocery payments, many patrons have interaction in a variety of cost-cutting habits. Evaluating costs and switching from identify manufacturers to generic or retailer manufacturers prime the listing, and no less than one-third of buyers say they “typically” take such measures to save cash,” Moquin defined. “One cost-saving behavior is of specific concern for meals and beverage manufacturers: switching to generic or store-brand merchandise. This development is comparatively constant throughout all age teams and dips solely barely amongst higher-income shoppers (these in households incomes greater than $100,000 yearly).”

Evaluating costs topped the listing of how for reducing grocery payments, with 46% of shoppers within the Morning Seek the advice of survey saying they typically use that technique, adopted by 36% who report typically shopping for private-label objects as a substitute of nationwide manufacturers. Different grocery cost-saving strategies typically utilized by respondents included coupons (cited by 25%), procuring at a number of shops (24%), shopping for in bulk (18%), buying much less meat (18%), shopping for in smaller portions (16%) and buying fewer objects general (16%).