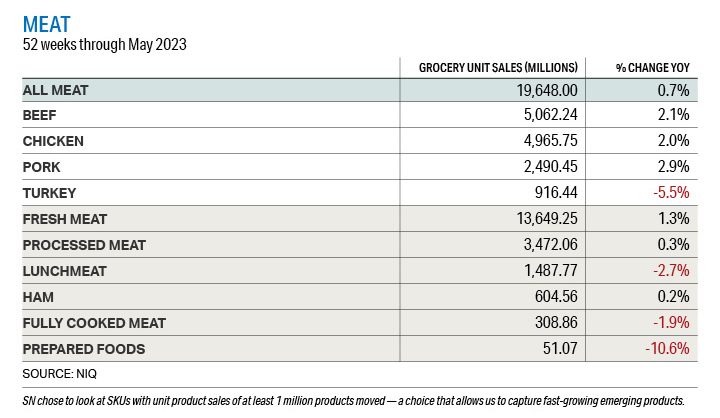

The meat class as a complete gained 4.7% in greenback gross sales progress, in line with knowledge from NIQ, with unit gross sales additionally holding regular, up 0.7%.

“Meat stays the king of the perimeter citadel with $90 billion in annual gross sales,” mentioned Anne-Marie Roerink, president of 210 Analytics LLC. “The greenback progress efficiency within the meat division is closely skewed by the very totally different ranges of inflation and deflation. All 12 months, costs of beef and pork have come down, whereas rooster and turkey suffered from very excessive inflation that’s solely beginning to come down in current months.”

Scott Patton, vp of nationwide shopping for for Aldi, mentioned that the low cost grocery store chain has grown meat purchases by almost 50% over the previous 5 years. “We do that by slicing pointless prices just like the butcher counter,” he mentioned.

With year-on-year quantity flat or barely down for a lot of the proteins, it’s the degree of inflation or deflation that has decided the greenback trajectory, Roerink mentioned. For instance, the NIQ knowledge signifies that rooster and lunchmeat skilled double-digit gross sales progress (each at 13.7%), nonetheless, rooster additionally grew in unit gross sales (2%), whereas lunchmeat unit gross sales went down 2.7%.

“The above-average efficiency in totally cooked meat exhibits the continued significance of comfort as an increasing number of shoppers combine and match objects cooked from scratch with objects that require simply (re)heating,” Roerink mentioned.

The NIQ knowledge signifies that turkey greenback gross sales rose 10.3% year-over-year, with beef up 0.7% and pork up barely, at 0.1%. Nonetheless, in unit gross sales progress, turkey was down 5.5%. Beef and pork unit gross sales remained within the inexperienced (2.1% and a pair of.9%, respectively). Additionally dropping in per unit gross sales had been ready meals, reporting detrimental unit gross sales of 10.6%.

The common worth per pound within the meat division throughout all cuts and varieties ended at $4.56 within the month of Could alone (for the 4 weeks ending Could 28, 2023), making it the primary time in lots of months that the common worth per pound within the meat division was beneath year-ago ranges (pushed by a lower within the worth per pound for processed meat), in line with a Could Market report by Circana and 210 Analytics.

The Could report confirmed beef experiencing a 2.2% lower in pound gross sales, whereas rooster pound gross sales elevated 1.8%. These had been marked as the 2 greatest sellers and remained pretty typical inside recessionary and inflationary patterns.

Prior to now 12 months, grinds generated $14.3 billion, with 84.6% of {dollars} and kilos being generated by floor beef (exceeding that of whole beef), with a year-on-year pound improve of 1.5%. Moreover, floor rooster, pork, and lamb gained in kilos in Could, with grinds bringing affordability and flexibility to the meat division, in line with the report.

Some 78% of Individuals self-identify as “meat eaters,” in comparison with simply 7% who describe themselves as vegan or vegetarian, in line with the 18th annual Energy of Meat report launched by the Meat Institute and FMI — The Meals Business Affiliation.